Ways to Choose the Most Suitable Auto Coverage for Your Needs

Locating the best auto insurance can frequently feel daunting, notably with numerous options available. As best car insurance Dallas , understanding your insurance needs is vital not only for your reassurance but also for your monetary safety on the road. Whether you are a beginner driver or have been behind the wheel for a long time, choosing the best car insurance policy that fits your way of life and financial plan is a decision you shouldn’t take lightly.

Auto insurance provides you with protection against a multitude of risks associated with driving, such as accidents, theft, and liability for damage to third-party vehicles. With different types of coverage and different policy limits, it is important to assess your individual needs and preferences. By investing the time to carefully evaluate your options, you can guarantee that you are adequately covered without overpaying for excessive features.

Comprehending Auto Protection Fundamentals

Auto insurance is a agreement between a policyholder and an insurer that offers financial protection against damages related to owning a vehicle. When you buy car insurance, you promise to pay a fee in exchange for insurance that aids safeguard you against various threats, including collisions, stealing, and damage. The contract defines the duties of both sides and the terms under which demands can be made.

There are various types of vehicle coverage provided to vehicle owners, including responsibility coverage, impact coverage, and comprehensive coverage. Third-party insurance is required in most jurisdictions and covers amounts associated with harm to other people or property if you are to blame in an incident. Collision coverage helps pay for harm to your own in the event of an accident, while all-perils insurance protects against other incidents such as stealing or natural disasters. Comprehending these options is vital to determining a coverage that fits your requirements.

Aspects influencing your vehicle coverage rates include your past driving behavior, the model of car you operate, your financial score, and the level of insurance you select. Insurance companies consider these elements to determine the risk assessment they will accept when giving you coverage. It is important to regularly review your policy and compare different companies to ensure you are getting the optimal worth and coverage for your investment.

Evaluating Personal Coverage Requirements

Grasping one's personal coverage requirements is vital in selecting the appropriate auto insurance policy. Begin by analyzing your vehicle's value, which plays a major role in deciding the extent of protection needed. In case you possess a modern or luxury car, you may want to consider comprehensive and collision coverage to protect your investment. On the other hand, if you have an older vehicle, you may opt for liability coverage only, as it can be relatively cost-effective.

Next, consider your driving habits and individual risk factors. If you frequently drive in crowded urban areas or engage in long commutes, you may face a increased risk of collisions, thereby requiring a more extensive coverage plan. Furthermore, assess your financial situation and how much you can afford as a deductible in the event of a claim. A higher deductible usually means lower premiums, but it is essential to ensure that you can comfortably pay it should the necessity arise.

In conclusion, don't forget to factor in any legal requirements specific to your state. Many states mandate a basic amount of liability coverage, but it is often recommended to opt for higher limits to protect yourself against possible lawsuits arising from accidents. By thoroughly evaluating these factors, you can make well-informed decisions that align with your particular coverage needs and financial circumstances.

Comparing Insurance Companies

While searching for the appropriate auto insurance, it is essential to contrast various insurance providers. Every company offers different coverage options, premium rates, and customer service support. Commence by collecting quotes from several providers to find a selection of prices for like coverage. This will assist you pinpoint the typical cost and identify any anomalies that may offer exceptional value or high charges.

Next, examine the coverage options provided through every insurer. Not every policy is designed equal; while one provider may offer full coverage at a reasonable price, another might lack crucial features. Be on the lookout for supplementary benefits, such as roadside assistance, rental car reimbursement, or accident forgiveness. Understanding what every provider includes in their policies can significantly impact your decision.

Finally, consider the reputation and customer service of the insurance providers you are assessing. Investigate online reviews, ratings from independent agencies, and feedback from family. A company with a robust support system can make a significant difference when you need file a claim or have inquiries about your policy. Prioritizing both cost and quality will guarantee that you pick an insurance provider that satisfies your needs effectively.

Evaluating Discounts plus Premiums

When picking car insurance, it's important to assess the different discounts available that can greatly lower your premiums. Many insurance providers offer discounts for safe driving records, low mileage, multiple policy holders, and even for being a participant of specific organizations or associations. Be sure to check about any discounts you may qualify for, as these can lower your overall insurance cost and make your policy more affordable.

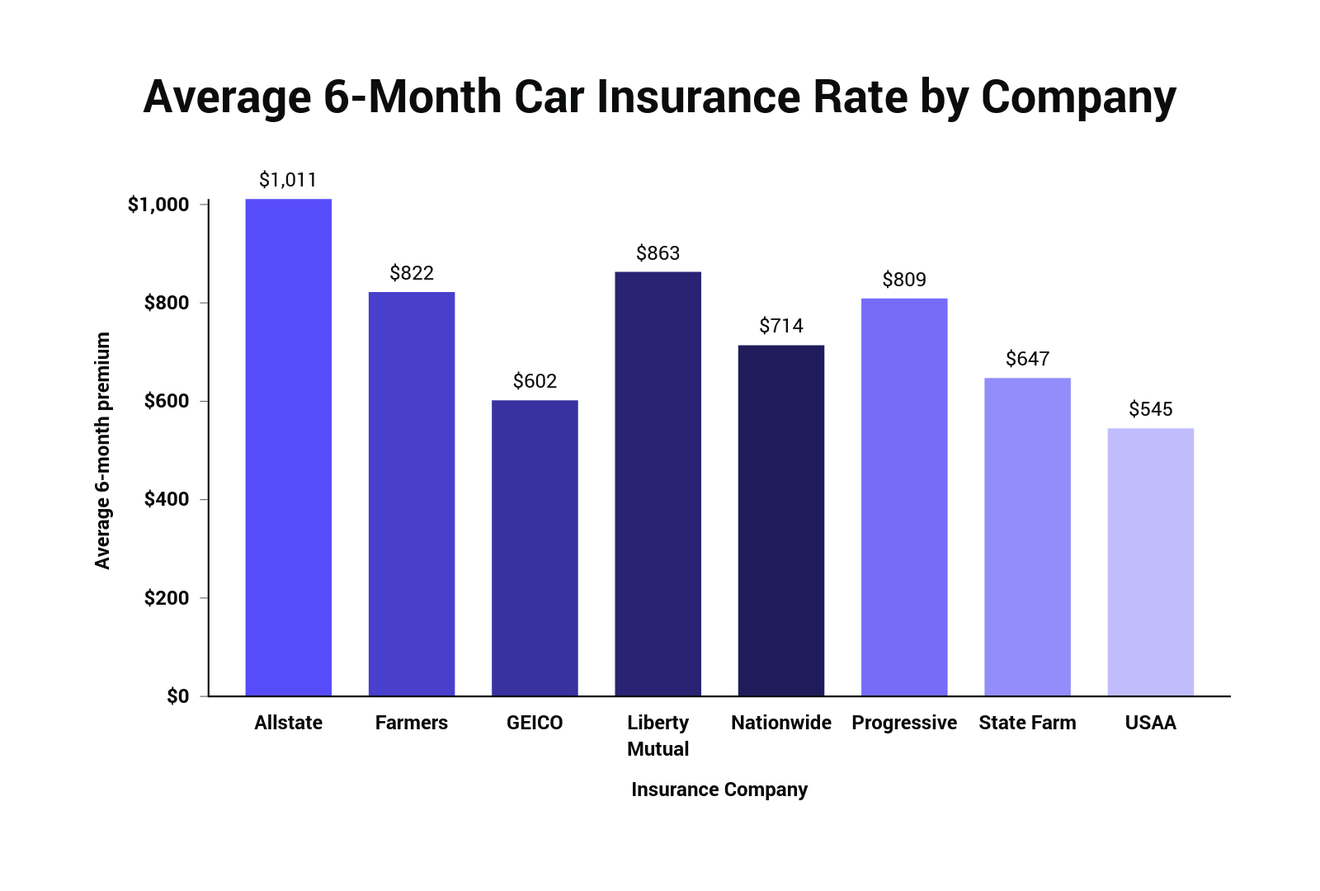

Evaluating premiums from various insurers is a necessary step in finding the best auto insurance for your requirements. Each company uses its own measures to evaluate risk and determine policy rates, meaning that premiums can fluctuate widely between providers. Obtain estimates from multiple insurers and compare what coverage options and limits are included in each policy. This way, you can confirm that you are getting the best value for your premium.

Finally, consider how premium rates can shift over time. Elements such as changes in your driving habits, credit score, or even the claims history of your insured vehicle can alter your premiums. Regularly reviewing your policy and shopping around for better rates can help you stay informed and ensure you're not paying more than necessary for your auto insurance. Keeping these aspects in mind will help you arrive at a much informed decision that aligns with your budget and coverage needs.

Examining the Fine Print

While selecting auto insurance, it is important to pay close attention to the fine print of your policy. This section holds vital aspects regarding coverage caps, exclusions, and distinct terms that could significantly affect your claims process. Many customers neglect these details, assuming that their coverage is more extensive than it may actually be. Dedicate time to take the time to read through this information carefully to make sure you are fully aware of what is covered and what is omitted.

Another crucial factor to examine is the terms under which your policy will honor claims. Some policies may have particular requirements for making a claim or may constrain coverage based on particular circumstances. Understanding these conditions will help you avoid surprises in the regrettable event of an accident. Be certain you know the period for reporting incidents, the documentation required, and any other stipulations that might be involved when seeking coverage.

At last, be cautious of the terminology used in the fine print. Insurance documents often include jargon that may not be understood to everyone. If you find the language confusing, do not hesitate to ask your insurance agent for assistance. Knowing exactly what each term signifies can help you make an educated decision and confirm that you select the auto insurance policy that best fits your needs and provides you with adequate protection.

Concluding Your Coverage Choice

When you have gathered quotes and compared coverage options, it is time to make a definitive decision regarding your auto insurance policy. Meticulously review each policy's details to verify that it meets your specific needs. Concentrate attention to crucial aspects such as deductibles, coverage limits, and any benefits or discounts that may be offered. This will help you evaluate your options thoroughly and pick a policy that offers the best value for your needs.

Ahead of committing to a policy, consider getting in touch to the insurance provider for further clarifications or questions. Grasping the terms and conditions is essential, as this can impact your financial responsibilities in the instance of an accident or claim. Additionally, ask about the claims process and customer service reputation of the insurer to ensure a smooth experience when it matters most.

After selecting your policy, take the opportunity to assess your decision from time to time. Life changes such as new cars, relocations, or changes in driving habits can affect your insurance needs. Consistently evaluating your auto insurance will help you keep adequately covered and may lead to potential savings if you identify better rates or coverage options in the market.