Understanding Automobile Insurance: What Each Motorist Should Know

Auto insurance is an essential aspect of prudent vehicle ownership, providing monetary protection against a number of risks that drivers experience on the road. For many, navigating the landscape of auto insurance can be daunting, with a wide range of options, coverage types, and terms that might look complicated at first. Understanding the basics of car insurance is crucial not only for compliance with statutory requirements but also for safeguarding your financial well-being in the event of an incident or damage to your vehicle.

As a driver, being aware about car insurance assists you make wiser decisions about the coverage you need. From liability and collision coverage to understanding deductibles and premiums, there are many factors that affect your insurance experience. This article seeks to explain the essential elements of car insurance, helping you grasp what every driver should know to ensure they are properly protected while on the road.

Types of Car Insurance

There exist several types of car insurance coverages available, each tailored to satisfy diverse wants and needs of drivers. Among the most prevalent types is liability insurance, which is required in most states. This coverage pays for the damages and injuries caused to others in an accident where you are at fault. It typically includes bodily injury liability and property damage liability, shielding you from financial loss from claims made by others.

Another popular type is comprehensive coverage, that safeguards your vehicle from non-collision-related incidents. This includes theft, vandalism, natural disasters, and hitting an animal. Comprehensive insurance is particularly valuable for those who live in areas susceptible to such dangers or for drivers with newer, more expensive vehicles. It provides confidence knowing that you are covered not just for accidents on the road but for unforeseen events too.

Collision insurance is a further essential component of many drivers' auto insurance policies. This coverage pays for damages to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. If you are financing or leasing your car, lenders typically require collision insurance. Collectively, these types of coverage help ensure that you are safeguarded financially in a range of driving situations, giving you the confidence to hit the road.

Elements Affecting Insurance Costs

Multiple key aspects affect the premiums that vehicular operators pay for car insurance. One significant aspect is the driver's age and driving experience. In general, younger drivers or those with limited experience tend to face higher costs due to their greater tendency of incidents. Insurers typically view more mature, more experienced drivers as more responsible behind the wheel, which can lead to reduced premiums.

The kind of vehicle also holds a significant role in affecting insurance costs. Automobiles that are higher-priced to fix or replace generally come with elevated costs. Additionally, cars with sophisticated safety features may receive lower rates, as they are seen as less prone to be part of severe accidents. Insurers will also take into account the risk of theft or the automobile's safety ratings.

An additional significant aspect is the driver's history of insurance claims and financial rating. A history of previous claims can signal to insurers that a driver is at greater risk, resulting in increased costs. Similarly, car insurance near me open now can impact costs, as insurers commonly use it as a indicator of fiscal responsibility. Increased credit scores may cause diminished premiums, while diminished scores could indicate higher costs for auto insurance.

How to Select a Right Policy

Choosing the right car insurance policy starts with understanding your unique needs as a driver. Think about factors such as your motor habits, the type of vehicle you own, and your budget. When you drive a modern car, you may want a policy with full coverage to protect against loss or harm. On the other hand, if your car is older, minimum liability coverage may be adequate. It's important to evaluate how much coverage you need based on your risk tolerance and lifestyle.

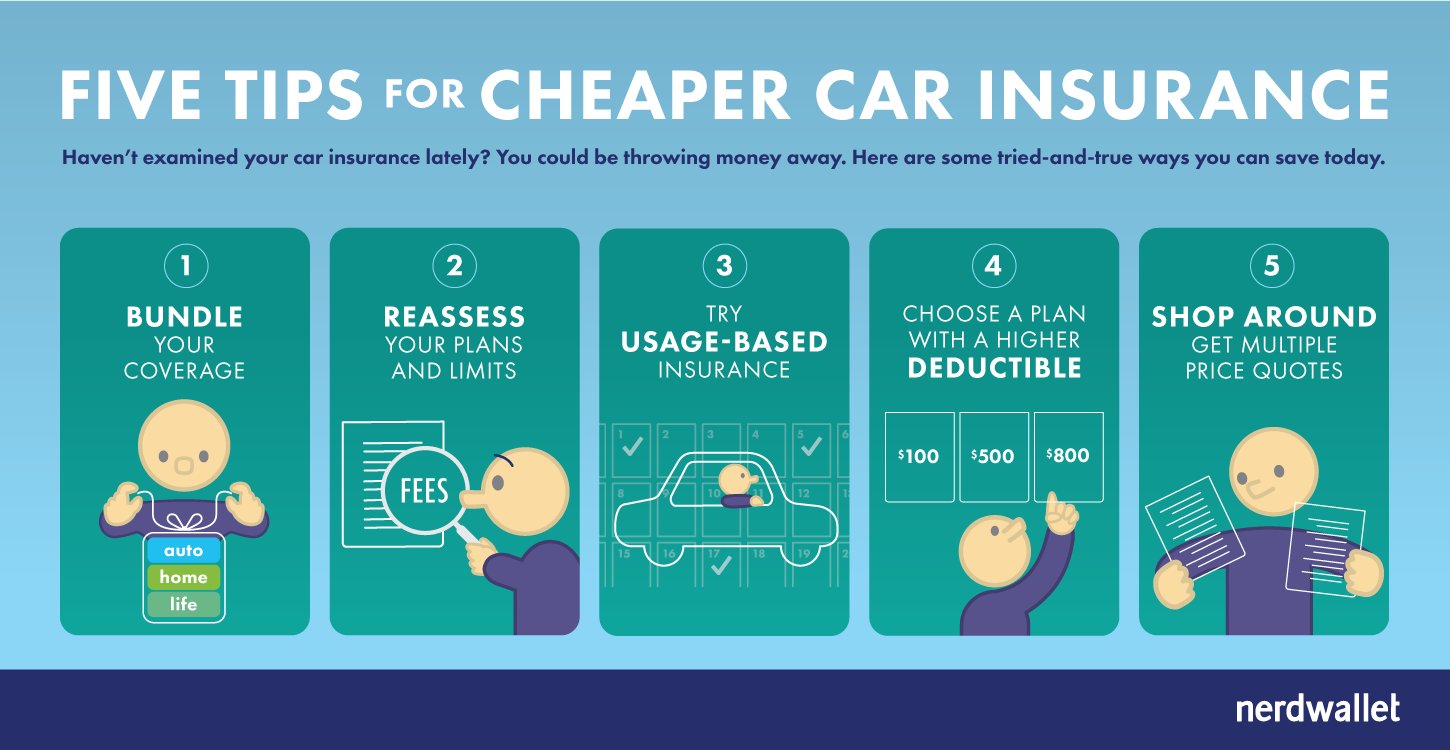

Then, shop around and compare quotes from different providers. Insurance companies often have diverse rates for identical coverage, so taking the time to gather multiple quotes can lead to considerable savings. Consider focusing solely on just the price; review the company’s standing, customer service, and claims process. Reading reviews and asking friends or family about their experiences can give perspectives into which insurers are dependable and offer comprehensive support.

In conclusion, understand the terms and conditions of each policy before finalizing a decision. Pay attention to the deductibles, coverage limits, and any exclusions that may apply. Don't hesitate to consult insurance agents for clarification on any aspects you find ambiguous. The goal is to ensure you find a policy that not only fits your budget but also provides you peace of mind while on the road.